Trading in the Fno Stock Market, which stands for Futures and Options—is a widely adopted method for investors seeking to hedge risks or earn profits through market speculation. Unlike the cash segment, where trades involve actual buying and selling of stocks, F&O trading is based on contracts derived from underlying assets. With the growth of digital platforms and accessible tools, even retail investors can now enter this segment confidently by using a reliable investing app.

Before diving into the mechanics of F&O trading, it’s important to understand that this segment comes with higher risk but also offers opportunities for strategic investment. A well-designed investing app can help streamline your experience, providing market data, analysis, and execution tools at your fingertips.

What Is the Fno Stock Market?

The Fno Stock Market involves two main types of derivative contracts: Futures and Options. These are agreements to buy or sell an asset at a predetermined price on a future date. Futures are binding contracts, whereas options give the buyer the right, but not the obligation, to execute the trade.

This market enables participants to speculate on the price movements of stocks, indices, and other financial instruments without owning the underlying asset. The F&O segment is also used by institutional investors and traders to manage risk and protect portfolios.

Key Concepts Before You Begin

Understand the Contract Types

- Futures Contracts: Agreements where both buyer and seller are obligated to execute the trade at the set date and price.

- Options Contracts: The buyer holds the right to buy (call option) or sell (put option) but isn’t required to complete the deal.

Know the Market Participants

- Hedgers: Protect existing positions against market fluctuations.

- Speculators: Aim to profit from price movements without holding the underlying asset.

- Arbitrageurs: Exploit price differences across markets for gains.

Margin Requirements

Unlike traditional trading, F&O trading requires only a margin amount, not the full contract value. This increases exposure but also introduces higher risk. Most investing apps display margin requirements clearly, making it easier to manage positions.

Steps to Start Trading in the Fno Stock Market

1. Open a Trading and Demat Account

The first step is to open a trading and demat account with a registered broker. Ensure the broker provides F&O access and has a user-friendly investing app that supports analysis tools, charts, and order placement.

2. Understand Lot Sizes and Expiry Dates

Each futures or options contract has a defined lot size and an expiry date. You cannot purchase one single share in F&O; instead, you buy lots of shares. Expiry usually falls on the last Thursday of every month.

3. Learn to Read Market Indicators

Effective F&O trading involves tracking indicators such as:

- Open interest

- Implied volatility

- Option chain data

- Price movement trends

A modern investing app can help visualize these metrics with real-time data feeds.

4. Choose a Strategy

Popular F&O strategies include:

- Covered Call

- Straddle

- Strangle

- Iron Condor

- Butterfly Spread

These methods depend on your market outlook—whether bullish, bearish, or neutral.

5. Practice Risk Management

F&O trading can lead to significant gains but also heavy losses. Use stop-loss orders, set clear entry and exit points, and avoid overleveraging. Many investing apps offer built-in calculators and alerts for risk control.

Advantages of Trading in the Fno Stock Market

- Leverage: You control larger positions with a smaller capital outlay.

- Hedging Tool: Protects your investments during volatile times.

- Diverse Strategies: Provides multiple ways to benefit in rising, falling, or sideways markets.

- Liquidity: The F&O segment often has high volume, ensuring smoother trade execution.

Common Mistakes to Avoid

- Ignoring Expiry Dates: Contracts must be squared off or exercised before expiry.

- Lack of Knowledge: Jumping into trades without understanding the underlying asset.

- Overtrading: Placing too many trades based on speculation can quickly exhaust your capital.

- Neglecting Fees: F&O trades include brokerage, exchange fees, and taxes. Know your costs.

A good investing app can help prevent these mistakes by providing alerts, educational resources, and a summary of transaction charges.

Tools That Can Help

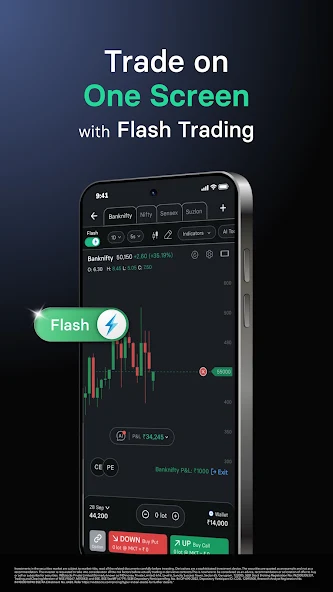

Modern-day trading platforms offer several features that enhance the trading experience:

- Real-time market updates

- Strategy builders

- Virtual trading or simulators

- Price alerts

- In-depth charts and analytics

By using a well-equipped investing app, traders can make informed decisions and act quickly as market conditions change.

Conclusion:

The Fno Stock Market is a compelling opportunity for those looking to diversify their investment strategies and maximize potential returns. With the right knowledge, disciplined approach, and use of a feature-rich investing app, trading in this market becomes more structured and less intimidating.

As with any form of trading, education and risk management are essential. Start small, experiment with strategies in a safe environment, and gradually build confidence before scaling your trades. Whether you’re looking to hedge or speculate, the F&O segment can become an essential part of your trading journey when approached wisely.